2023 farm cash receipts continue to trend upward – again

While 2022 brought its fair share of challenges for Canadian agriculture, one bright spot has been the healthy trend in farm cash receipts (FCR). We estimate they reached a record high of $94.5B in 2022, an increase of 14.1% over 2021. Looking forward, we expect FCR to continue growing in 2023, although at a more moderate pace of 4.6%. FCR are only part of the profitability outlook for Canadian farms. Yet, robust FCR would be a positive development in 2023 to offset input costs that are anticipated to stay elevated throughout the year.

Looking back – looking forward

Statistics Canada is set to release complete FCR data for 2022 later this year. Our 2022 estimates and projections of year-over-year (YoY) changes in FCR (Table 1) incorporate StatCan FCR estimates for the first three quarters and data from various other sources. The largest YoY gains in 2022 FCR (measured in %) were recorded in the Atlantic provinces, Alberta and Ontario. The largest projected increases in 2023 FCR are in Saskatchewan, British Columbia, and Manitoba.

Table 1: Estimates and projections of FCR by province/region

Sources: FCC forecasts use Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries; futures data from CME.

Grains, oilseeds and pulses receipts to remain very strong

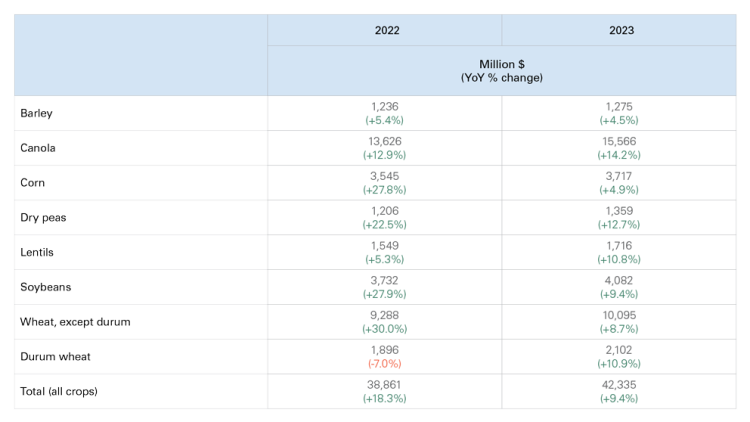

FCR for grains, oilseeds and pulses is projected to grow by 9.4% in 2023 (Table 2), following an estimated increase of 18.3% in 2022. The main drivers of these positive revenue outcomes are:

A YoY rebound in 2022 Prairie production (part of which will be marketed in 2023) and average yield assumptions for the 2023 harvest.

Crop prices remain above their five-year average due to the tight balance between global supply and demand.

Corn and soybeans are expected to continue generating strong revenues. Of all the Prairie crops, canola revenues are projected to grow faster, with peas and lentils not far behind. Wheat is forecast to produce increased revenue streams as well.

Table 2: FCR estimates and forecasts for selected crops

Sources: FCC forecasts use Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and table 32-10-0351 for deliveries; futures data from CME.

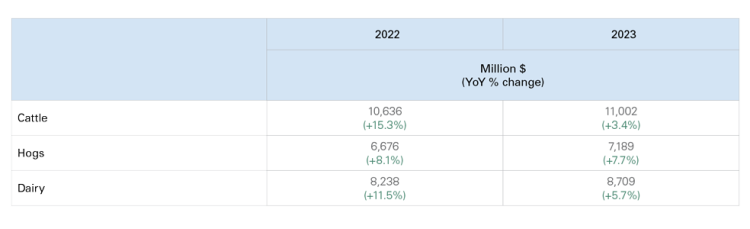

Livestock receipts driven by elevated prices

Cattle prices have steadily increased in the second half of 2022 and, at the start of 2023, remain above their 5-year average values. U.S. hog prices in 2022 trended closely with 2021 values, but regional pricing adjustments brought downward pressures on receipts in some provinces. The demand for red meat remained strong domestically amid elevated retail food inflation. Global demand for beef and pork is strong but has weakened in certain parts of the world (e.g., China). The demand for Canadian cattle and hogs should remain robust, given the limited upside in 2023 supply in the U.S. Cattle receipts are projected to increase further by 3.4% in 2023, while hog FCR should grow by 7.7% (Table 3).

Table 3: Estimates and forecasts for selected livestock sectors

Sources: FCC forecasts use Statistics Canada table 32-10-0077 for prices, table 32-10-0046 for FCR and futures data from CME.

Demand for dairy products in 2022 was fairly stable, but two increases in the farmgate milk price resulted in a projected increase of 11.5% in FCR. In response to increasing costs for feed and energy, the Canadian Dairy Commission will increase the support price for butter on February 1st, 2023, estimating it will result in a 2.2% increase in the milk price. Milk production should grow given limited butter stocks, although imports and retail inflation could tamper with domestic market requirements. Overall, FCR are projected to grow by 5.7% in 2023.

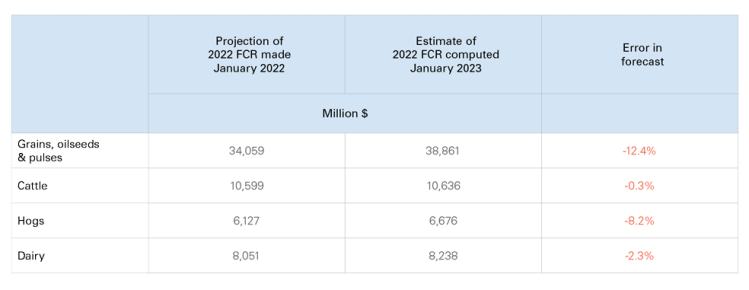

How reliable are these forecasts?

The usual words of caution apply to the forecasts above: they reflect current market conditions and expectations for the rest of the year in the absence of available data. A look at the performance of our forecasts released a year ago shows that, overall, last year’s forecasts were too conservative (Table 4). We didn’t anticipate pricing at the farm level to be as good as our most recent estimates of the 2022 FCR show. With a forecast error of -0.3%, our cattle receipts forecast was the most accurate. Conversely, the war in Ukraine and the resulting pricing volatility can explain most of the deviations recorded for 2022 forecasts and 2023 estimates of grains, oilseeds and pulses FCR (-12.4%).

Table 4: Recent estimates of 2022 FCR vs. a year-old forecast

Source: FCC calculations

Additional resources for a successful 2023

We’ve reviewed the top 10 charts to monitor to help you anticipate the evolution of economic trends throughout 2023. We’ll publish over the coming weeks a series of sector-specific outlooks to unpack the drivers behind these FCR forecasts in this post.

Executive Vice President, Strategy and Impact and Chief Economist

J.P. Gervais is Executive Vice President, Strategy and Impact and Chief Economist at FCC. His insights help guide FCC strategy, monitor risks and identify opportunities in the economic environment. In addition to acting as an FCC spokesperson on economic matters, J.P. provides commentary on the agriculture and food industry through videos and the FCC Economics blog.

Prior to joining FCC in 2010, J.P. was a professor of agricultural economics at North Carolina State University and Laval University. J.P. is a Fellow of the Canadian Agricultural Economics Society. He obtained his PhD in economics from Iowa State University in 1999.