2023 Cattle and hog outlook update: Strong red meat demand likely not enough to rescue eastern hog producers

This is the first quarterly update to our 2023 Outlook for cattle and hogs published in February. Over the last two weeks, we updated our Outlooks for dairy and major crops.

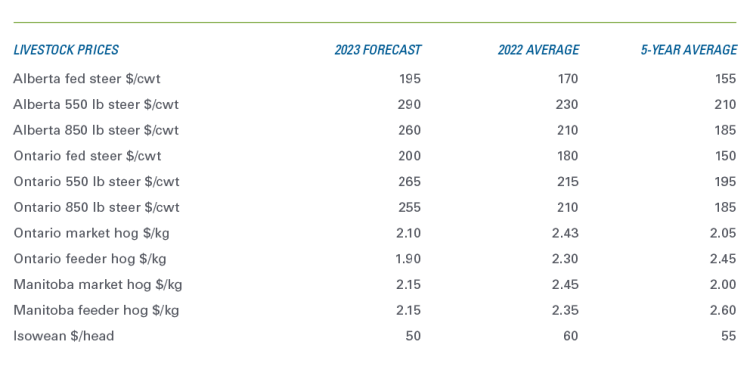

Cattle prices for 2023 are forecasted to be higher year-over-year (YoY) and above the five-year average, thanks to the smaller North American herd creating beef production challenges. Our forecasts for the outlook period have all risen since our February outlook (Table 1*).

Cow-calf profit projections are also positive, with expected revenues climbing and average costs falling YoY. Margins in 2023 are expected to be above the five-year average, and that positive outlook extends well beyond the next three months. This will be the year when feedlot margins will likely rise to be closer to break-even, with some backgrounders into the black, after years of profitability pressures. Lowered feed costs in the West will also help boost margins there.

Table 1: Cattle prices rise on bullish factors; uncertainty and bad news cloud the hog sector

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

* Due to a change in methodology, the table used in our February outlook can’t be directly compared to this table.

On the heels of the big news from Olymel in Quebec, the outlook for hog prices has weakened since February. Ontario market hogs have dropped from their 2022 highs and are now more in line with their five-year average. Eastern and Western feeder hog prices have dropped YoY and remain below their five-year average. In the West, Manitoba market-ready hogs have also dropped YoY but remain elevated above the average. We expect isowean prices to fall YoY and average out at less than their five-year average. All in all, volatility’s ahead for the sector.

Isowean profitability is expected to trend higher in 2023, close to break-even or positive. Margins of western farrow-to-finish operations will continue to be positive, whereas eastern margins will drop YoY for the second year due to softening prices and feed costs that are relatively higher than in the West.

Trends to monitor in 2023

The shrinking North American cattle herd, elevated feed costs and red meat demand are the three major factors to monitor that we identified in February. However, Olymel’s news of its Vallee Jonction plant closing tops the list for Canada's eastern hog markets. Hog producers in the East won’t have the same slaughter capacity to fill, with reductions in the Quebec hog herds expected to total 1 million. A new hog marketing agreement in QC will lower producer prices and introduce future profit-sharing options between processors and producers.

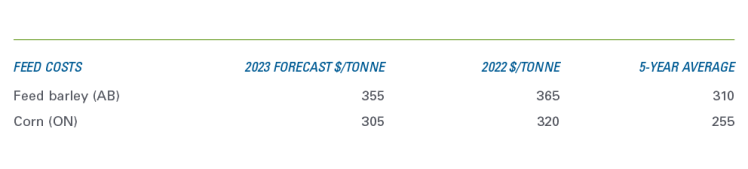

Feed costs continue to trend lower

With Russia threatening to refuse to re-sign the Black Sea deal that would facilitate grain exports during the ongoing war in Ukraine, the break in feed costs expected for 2023 may be challenged. However, prices to date and those forecast for the year have given Canadian livestock producers a reprieve.

Table 2: Year-over-year price declines to help ease margin pressures

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

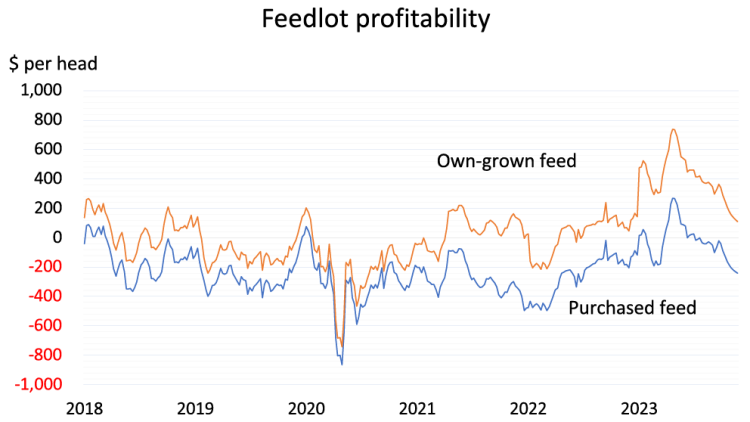

The reprieve will directly impact cattle producer profitability (Figure 1). The availability of the better feed grain crop in 2022 was a factor in the improved margins of that year. As feed costs continue to weaken throughout the first half of 2023, profitability is expected to improve.

Figure 1: Feed prices directly impact cattle profitability

Sources: Canfax, AFSC, FCC Economics calculations

The effect on profitability is even more pronounced in a high feed cost environment when producers grow their own feed. Own-grown feed costs have made a significant, consistent difference to margins since 2021.

The current strength of beef demand continues to drive cattle market fundamentals

The contraction in the North American cattle herd is likely slowing as conditions improve in fields and markets. Nonetheless, the USDA raised their forecast for 2023 domestic beef production in April (to 26.8 billion pounds) based on higher anticipated slaughter numbers in Q2 and Q3. The March 1 Cattle on Feed report showed a correspondingly lowered feedlot inventory, down more than 4% YoY. In Canada, federally inspected packers have slaughtered 2.2% fewer heads YoY as of April 22. The Canfax cattle on feed report for April 1 showed inventories 9% lower YoY, with consistent YoY declines each month since August 2022. Fed cattle prices, one of the outcomes of consistently high beef demand, reflect this movement through the system.

The U.S. is heading into its busiest season for beef demand with the Memorial Day weekend festivities, which are helping to drive current slaughter numbers there. However, bearish factors such as slowing economic growth and higher interest rates are likely to weigh on upcoming demand in both the U.S. and Canada as discretionary spending takes a back seat to debt repayment. Chinese beef demand is expected to be strong as the country continues to break away from pandemic-related economic restrictions and will support global beef prices. According to McKinsey, there’s a movement in China away from pork consumption to beef, which is seen as better value, better quality and healthier – although pork remains the country’s meat of choice.

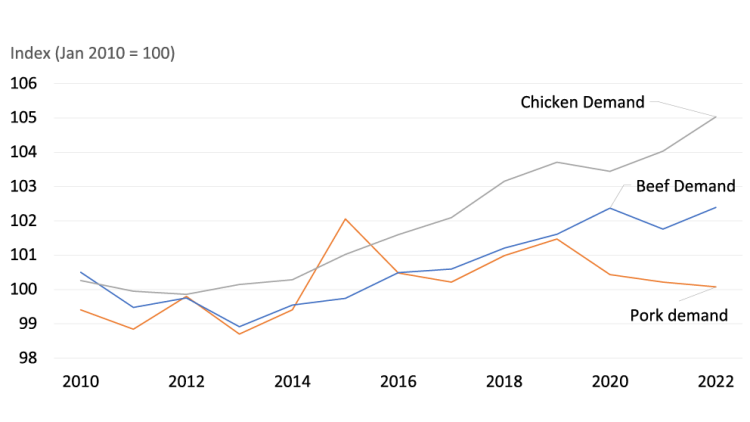

The Chinese red meat market highlights the divergence we see in the demand for beef and pork (Figure 2). FCC Economics’ meat demand index shows the different trajectories of Canadian demand for the two red meats.

Figure 2: The different influences of a pandemic on beef vs. pork demand

Source: Statistics Canada

Canadians still prefer beef despite high prices, with beef demand climbing steadily since 2013. With an added boost in 2015, pork matched the growing demand until 2019, when it started falling. Throughout the pandemic (2020–2022), disposable income and pent-up demand benefitted the cattle supply chain while reducing demand for pork. However, pork prices are down relative to beef and chicken, which should move consumption towards pork, everything else being equal.

Bottom line

The demand for red meat is expected to be strong for the first half of the outlook period and well into the second half when Canadian bar-b-que season begins. Overseas demand is also robust, although Canada isn’t a large meat exporter to China, as are South American, U.S. and Oceanic exporters. But even a good bar-b-que season won’t be enough to offset the major changes to eastern hog production.

Economics Editor

Martha joined the Economics team in 2013, focusing on research insights about risk and success factors for agricultural producers and agri-businesses. She has 25 years’ experience conducting and communicating quantitative and qualitative research results to industry experts. Martha holds a Master of Sociology degree from Queen’s University in Kingston, Ontario and a Master of Fine Arts degree in non-fiction writing from the University of King’s College.