- Home

- News

- Favourable autumn conditions see rise in winter cropping for harvest 2023: Grain market daily

Favourable autumn conditions see rise in winter cropping for harvest 2023: Grain market daily

Tuesday, 15 November 2022

Market commentary

- UK feed wheat futures (May-23) fell £2.75/t over yesterday’s session, closing at £269.75/t. The new crop contract (Nov-23) closed at £251.25/t yesterday, down £2.25/t from Friday’s close.

- Domestic futures followed European grain markets down yesterday, mainly due to expectations that the Ukrainian export corridor deal would be renewed, after ‘constructive’ talks between the UN and Russia on Friday last week.

- Today, prices continue to fall further on news of further progress. With the Russian Foreign Minister stating the UN has informed him of written assurances from the EU and US to remove obstacles to Russian grain and fertiliser exports. Today, UK feed wheat (May-23) futures are trading at £262.50/t (15:30).

- Yesterday, Saudi Arabia’s state buyer said that it had bought over 1Mt of milling wheat in an international tender, more than had originally been planned.

- Paris rapeseed futures (May-23) were down €8.75/t from Friday, closing at €625.75/t yesterday. These prices tracked the wider oilseed complex down, with pressure from Ukrainian export news and Chinese demand concerns.

Favourable autumn conditions see rise in winter cropping for harvest 2023

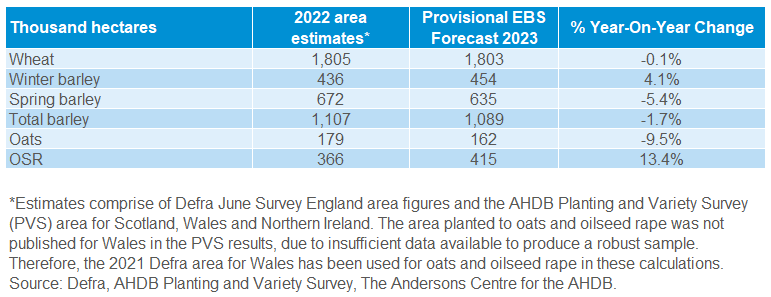

Today sees the provisional release of the AHDB Early Bird Survey for Plantings and Planting Intentions for harvest 2023. This provides a first look at the area planted in the UK for wheat, barley, oats and oilseed rape.

With UK area information yet to be published for 2022, the 2022 area data used in this release is the Defra June Survey England area, combined with the areas for Scotland, Wales and Northern Ireland from the AHDB Planting and Variety survey. More information on this can be found here.

The key message within the survey data shows that favourable autumn conditions, sees winter cropping rise further despite rising fertiliser costs.

For harvest 2023, the intended area planted to wheat is relatively unchanged (-0.1%) on the year, at 1,803Kha. While new crop UK feed wheat prices remain supported, so do fertiliser prices. As such, we could see growers try and mitigate some of the rise in costs and apply less fertiliser, which may impact the quality/quantity of the crop next season.

With an earlier finish to harvest and good autumn weather for most, winter barley plantings are estimated to be up 4.1% on the year, at 454Kha. If realised, this would be the largest winter barley area since 2003 (455Kha). The spring barley area is forecast down 5.4% on the year at 635Kha.

Finally, oilseed rape planting intentions for 2023 are pegged at 415Kha, up 13.4% on the year. While a significant jump on the year, as potentially oilseed rape area also gained from oat area, the figure remains considerably lower than before the ban of neonicotinoids. Going forward, high input costs and the ongoing issue of cabbage stem flea beetle could potentially act as a cap to further UK area gains going forward.

Click here to view the full survey results. In December, when Defra publish the final UK cereal areas for 2022, we will republish the adjusted Early Bird Survey results which will include the full crop and regional area breakdowns.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.