Please provide your zip code to see plans in your area.

Featured

Featured

premium subsidies

What are premium subsidies?

What are premium subsidies?

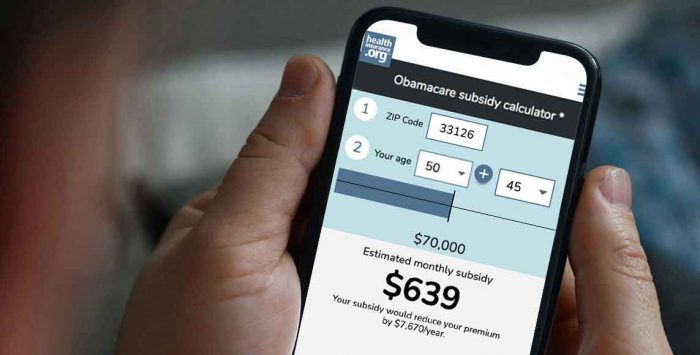

The Affordable Care Act’s premium subsidies – technically premium tax credits – were designed to help Americans purchase their own health insurance. They became available as of 2014, and for most people who enroll in coverage through the exchange/marketplace, the premium subsidies cover the majority of the monthly premiums.

The ACA premium subsidies are tax credits, but they can be taken upfront, paid directly to your health insurance company each month, to offset the amount you have to pay in premiums (as opposed to other tax credits, that can only be claimed on a tax return). The premium subsidy is then reconciled on your tax return, to make sure that the correct amount was paid on your behalf.

How many people receive premium subsidies?

As of early 2022, 90% of all marketplace enrollees were receiving premium subsidies. The average full-price premium was $587/month at that point, and the average subsidy covered $508 of that.

Are premium subsidies larger now?

Premium subsidies became larger in 2021, when the American Rescue Plan was enacted:

- The percentage of income that people have to pay for the benchmark (second-lowest-cost Silver) plan was reduced at all income levels. This has been extended through 2025 by the Inflation Reduction Act.

- The “subsidy cliff” was eliminated for 2021 and 2022, and that was also extended through 2025 by the Inflation Reduction Act.

Do I qualify for premium subsidies?

To qualify for premium subsidies, you must earn at least 100% of the poverty federal poverty level (FPL), unless you’re a recent immigrant. In most states, Medicaid eligibility has been expanded to cover people with income up to 138% of the poverty level, so premium subsidy eligibility starts above that level. There is normally an upper cap of 400% of the poverty level, above which premium subsidies are not available. But the American Rescue Plan and Inflation Reduction Act eliminated that cap from 2021 through 2025.

The “family glitch” used to prevent some families from accessing affordable health coverage, but IRS rules were finalized to fix the glitch as of 2023. That made some families potentially newly eligible for subsidies in the marketplace, but not all of them are actually eligible for subsidies.

Can I get premium subsidies with any insurance?

Premium subsidies are available nationwide, but only if you purchase coverage through the exchange/marketplace. In most states, HealthCare.gov is the exchange, but 17 states and DC run their own exchange platforms. Regardless of where you live, coverage purchased outside the exchange is not subsidy eligible.

Related articles

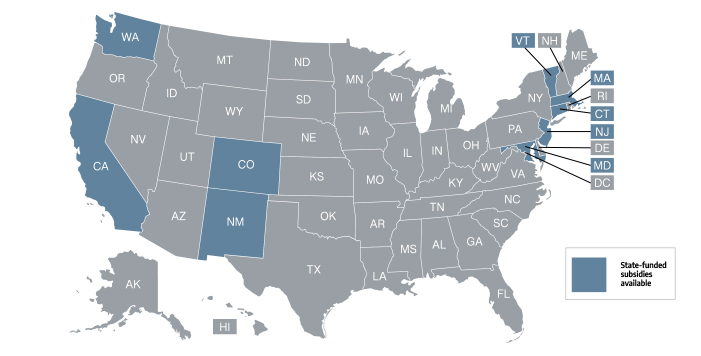

Nine states have state-funded health insurance subsidy programs that make coverage even more affordable than it would be with federal subsidies alone.

Legislation signed today provides substantial premium tax credits and cost-sharing reductions to Americans receiving unemployment benefits.

How the Affordable Care Act's subsidies are calculated, and who is eligible to receive them under the American Rescue Plan.

Sweeping health reform legislation delivered a long list of provisions focused on health insurance affordability, consumer protections.