AFT and SBPC Allege that Sham Lawsuit by Missouri Higher Education Loan Authority (MOHELA) Violates California Law; Company Potentially Liable for More than $175 Billion in Damages

October 11, 2022 | WASHINGTON, D.C. — Today, the American Federation of Teachers, AFL-CIO (AFT) and the Student Borrower Protection Center (SBPC) demanded student loan giant Missouri Higher Education Loan Authority (MOHELA) cease and desist from engaging in a range of unlawful loan servicing practices and end the company’s scheme to deny student debt relief to tens of millions of Americans.

MOHELA sits at the center of a lawsuit to block President Biden’s effort to cancel up to $20,000 in student debt for as many as 40 million people nationwide, including more than 3.5 million people across California. As the nation is recovering from the COVID-19 pandemic and remains buried under historic inflation, President Biden’s cancellation plan will lift as many as 20 million borrowers out of debt completely—with the greatest benefits going to lower-income borrowers and borrowers who were in default on their loans. SBPC and AFT allege that this lawsuit, prosecuted on behalf of MOHELA by right-wing Missouri Attorney General Eric Schmitt, is part of an unlawful scheme by the company to deny more than $58 billion in student debt relief to California families in violation of California’s Student Borrower Bill of Rights.

“MOHELA’s scheme isn’t just a betrayal of the trust it owes millions of student loan borrowers, it is part of a larger pattern of illegal behavior and must end now,” said Randi Weingarten, President of the American Federation of Teachers. “People with student debt in California and across the country have a right to life-changing debt relief and we will not let a rogue student loan company stand in the way.”

In 2020, California lawmakers enacted a Student Borrower Bill of Rights, barring any student loan servicer from “substantially interfering” with Californians’ rights to loan forgiveness. Companies that violate this prohibition are given a 45-day window to “cure” these illegal practices or face a private lawsuit on behalf of all affected California borrowers. Should MOHELA fail to withdraw its baseless lawsuit, the company may be liable for treble damages– private liability that could total more than $175 billion.

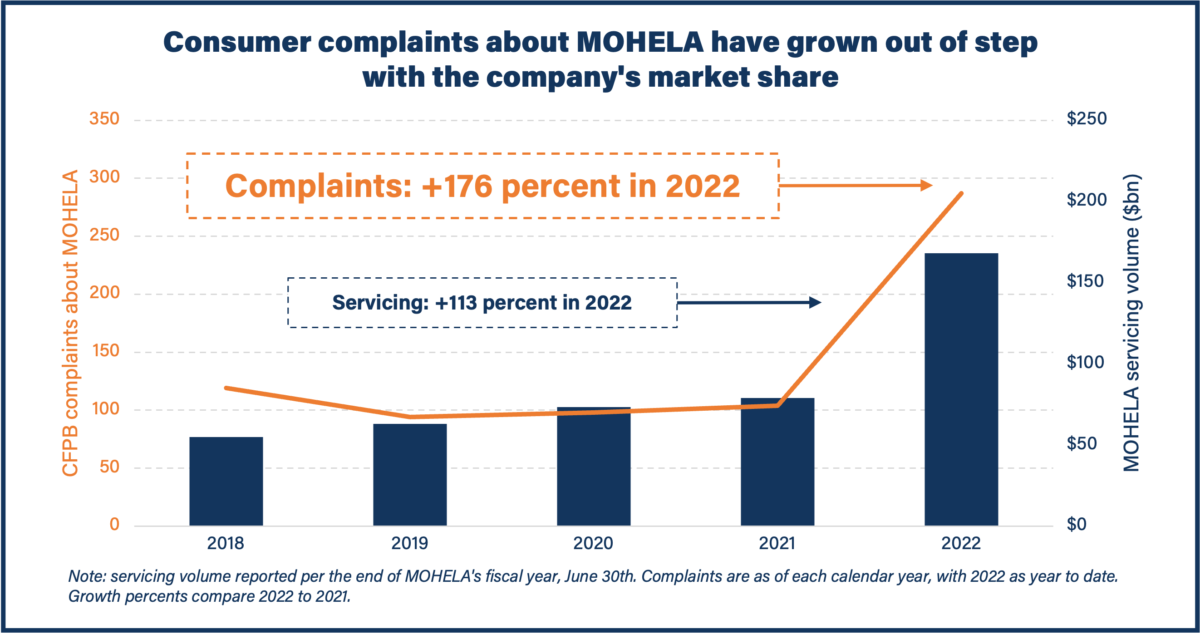

MOHELA appears to have engaged in this unlawful scheme to avoid making necessary investments in its loan servicing operations, which have been plagued by allegations of months-long paperwork processing delays and hours-long wait times to reach MOHELA representatives. Earlier this year, MOHELA became the sole federal contractor responsible for assisting public service workers pursuing debt relief under the Public Service Loan Forgiveness program. The volume of student loans handled by MOHELA has exploded, growing from less than $30 billion in June 2015 to nearly $170 billion today.

A copy of the Cease and Desist sent to MOHELA by AFT and SBPC is available here: www.protectborrowers.org/mohela

“Student loan giant MOHELA has grown fat on federal contracts and back-room deals with big banks. Now its executives think they are above the law and are using the courts to put their profits above the interests of student loan borrowers,” said SBPC executive director Mike Pierce. “Today’s action by SBPC and AFT shows that MOHELA cannot play politics with the financial lives of tens of millions of families in California and across the country.”

On Wednesday, October 12, 2022 a federal judge in Missouri will consider whether to grant MOHELA’s request to temporarily block student debt relief for all 40 million eligible student loan borrowers. On October 7, 2022, the U.S. Department of Justice filed a brief in response to this lawsuit offering new evidence that MOHELA’s lawsuit is rife with false statements and fundamentally misstates the law and policy it seeks to challenge.

About Mohela

In 1981, the Missouri legislature chartered MOHELA as an independent, private corporation to make and buy federal student loans that were guaranteed by the federal government. Congress ended this guaranteed loan scheme in 2010, eliminating MOHELA’s primary purpose. For more than a decade, however, the firm has cut deals with private student lenders such as SoFi and won huge federal contracts, growing into a financial services behemoth that principally provides student loan servicing to out-of-state student loan borrowers.

As of July 1, 2022, MOHELA became the primary federal contractor responsible for administering Public Service Loan Forgiveness—the federal student debt relief program that promises educators, healthcare workers, and millions of other public service workers debt cancellation in exchange for a decade of public service work. Since then, student loan borrowers have complained of hours-long wait times, months-long paperwork processing delays, improper rejections, disappearing payment histories, and more.

MOHELA has rapidly grown into one of the largest student loan companies in the world, handling more than one out of every ten dollars of all outstanding student loan debt. As MOHELA’s growth exploded, complaints from MOHELA customers have risen even more quickly.

About Nebraska, Missouri, et. al. v. Biden

On September 29, 2022, Missouri Attorney General Eric Schmitt, joined by Republican attorneys general in Kansas, Nebraska, South Carolina, and Arkansas, along with the Solicitor General of Iowa, filed a lawsuit in federal court in the Eastern District of Missouri seeking to block President Biden’s effort to cancel up to $20,000 in student debt for 40 million Americans. This lawsuit alleges that the State of Missouri, speaking on behalf of MOHELA, is suffering ongoing, irreparable harm due to increased “compliance costs” to the state-backed student loan company and the prospect of “imminent loss of revenue” should fewer Americans owe student loans. In effect, a state-backed student loan company hired to act as a federal contractor is asserting it has standing to veto federal student loan policy nationwide in order to protect its profits.

On Wednesday, October 12, 2022, a federal judge will hear arguments in this matter and consider whether to grant MOHELA’s motion to block student debt relief for tens of millions of people.

A copy of the complaint in Nebraska, Missouri, et. al. v. Biden is available here:

https://storage.courtlistener.com/recap/gov.uscourts.moed.198213/gov.uscourts.moed.198213.1.0_1.pdf

A copy of the reply brief filed by the U.S. Department of Justice is available here:

https://storage.courtlistener.com/recap/gov.uscourts.moed.198213/gov.uscourts.moed.198213.27.0.pdf

Arguments in Nebraska, Missouri, et. al. v. Biden will be live-streamed at 10:30 AM central time on October 12, 2022, here: https://www.youtube.com/channel/UCIWD5tA9DvZskM37uuuPBMg

###

About the American Federation of Teachers, AFL-CIO

The American Federation of Teachers represents 1.7 million pre-K through 12th-grade teachers; paraprofessionals and other school-related personnel; higher education faculty and professional staff; federal, state and local government employees; nurses and healthcare workers; and early childhood educators.

About Student Borrower Protection Center

The Student Borrower Protection Center (SBPC) is a nonprofit organization focused on alleviating the burden of student debt for millions of Americans. The SBPC engages in advocacy, policymaking, and litigation strategy to rein in industry abuses, protect borrowers’ rights, and advance economic opportunity for the next generation of students.

Learn more at protectborrowers.org or follow SBPC on Twitter @theSBPC.