We all know JPMorgan Chase is the largest funder of fossil fuels, and is the leading banker of climate chaos, by a long shot. But did you know that Chase’s reckless financing goes beyond fossils, and is actually having a negative effect on tropical rainforests?

Recently, RAN and our partners published the very first analysis of who’s financing tropical deforestation and land degradation in Southeast Asia, Brazil and Central and West Africa, and Chase ranks high on the list of complicit banks. Based on loans and underwriting to companies producing or trading commodities that are driving deforestation, like palm oil, beef, soy and pulp & paper, Chase ranks as the 4th worst banker in the world since the Paris Climate Agreement.

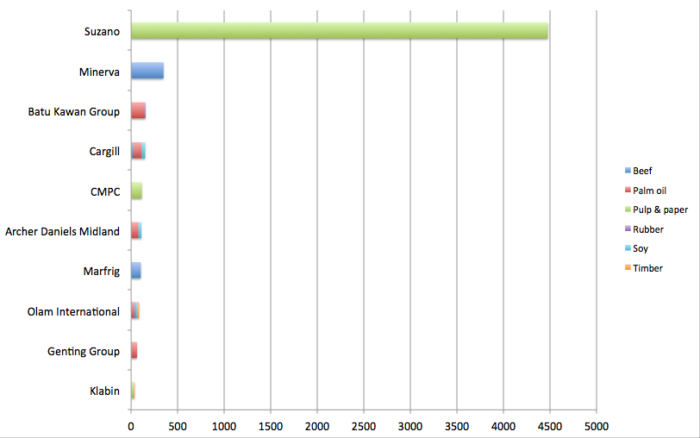

So who is Chase actually financing? We put together a graphic that gives a quick snapshot of its top 10 clients between 2016-2020 (April). Here are some key takeaways.

- Brazil paper giant Suzano is the largest recipient of credit from Chase, totaling nearly USD 4.5 billion (read more about their risks below).

- Chase provided USD 451 million in loans and underwriting to some of Brazil’s largest meatpackers, Minerva and Marfrig, which have been directly implicated in driving deforestation in the Amazon and fueling fires to create land for pasture.

- Chase has also financed conflict palm oil, totaling USD 466 million since 2016, with clients like Malaysia’s Batu Kawan Group (USD 146 million), parent company of Kuala Lumpur Kepong Berhad (“KLK”), which has repeatedly been exposed for labor abuses.

- On the investment side, Chase is the second largest investor in Japan’s largest trading company Itochu, which is a major trader of timber, pulp, palm oil, rubber, and soy from rainforest regions, sourcing from companies with a history of deforestation and rights abuses.

Suzano, the single largest recipient of finance

Based on analysis by Forestsandfinance.org, Brazilian pulp giant Suzano captured USD 30 billion in loans and underwritings for its pulp & paper operations over the past five years. This amount represents 15% of all known loans and underwriting to commodities driving deforestation and land degradation in the topics mapped in the Forests and Finance database and it makes Suzano, by far, the largest recipient of credit. JPMorgan Chase has been its largest financier.

Pulp is used to make all kinds of paper, like toilet paper, office paper and cardboard. Most pulp is made from trees. In some regions, natural forests are cut to make pulp. In the case of Suzano, it uses only plantation trees, mostly eucalyptus, but this requires a lot of land. To feed its 11 mills, with a combined pulp production capacity of 11 million tonnes pulp a year, it has 1.3 million hectares of eucalyptus plantations, which is an area larger than the island of Puerto Rico. Most of this production is for export.

Suzano became the world’s largest pulp producer after it merged with its Brazilian competitor Fibria, in 2018. Big banks stepped in to lend money for this merger, to the tune of USD 12.2 bln: JPMorgan Chase (USD 2.4 bln), BNP Paribas (USD 2.9 bln) and Rabobank (USD 2.9 bln) were some of the largest lenders. Since 2015, these 3 banks alone provided Suzano with USD 12.6 billion in loans and underwriting to its pulp & paper operations.

One paper mill eats up 17 Manhattans of forest space

The pulp and paper industry is very capital intensive, as the construction of a new modern mill costs a few billion dollars. Suzano owns 3 mills that came online in just the past 10 years, and appears to have plans for another new mill. The pulp sector is in rapid expansion in the global south, particularly in Brazil, which is attractive due to a combination of affordable land prices, governmental incentives and the fact that eucalyptus trees grow particularly fast there.

Each of these mills requires around 250,000 acres of monoculture eucalyptus plantations — that’s 17 times the size of Manhattan! Most of Suzano’s plantations are certified (FSC/PEFC) and Suzano has hardly any plantations in the Amazon. Yet, its plantations still cause a significant social and environmental impact. Here are a few of the key impacts fueled by financing from Chase:

Deforestation

Suzano may boast that its reliance on eucalyptus plantations are not causing deforestation in the Amazon, but that’s not the full story. By buying up former cattle pastures to expand its plantations, Suzano has intensified the competition for land in Brazil, and there’s reason to suspect that this has fueled expansion of cattle farmers into the Amazon, one of the largest culprits for current deforestation.

It’s also worth noting that a eucalyptus plantation is not a forest. It doesn’t have the biodiversity that forests have, and it doesn’t perform the same ecosystem services that a forest does. In fact, planting eucalyptus trees prevents deforested areas from regenerating.

Water shortage

The monoculture eucalyptus plantations consume large amounts of water, increasing water stress and affecting nearby communities and the local flora and fauna. Water shortages are common nowadays along the coasts of Espírito Santo and Bahia, where Suzano has 3 pulp mills, even though the region used to be home to lush rainforests.

Land conflicts

The establishment of large plantations often leads to land conflicts. The Brazilian states of Espírito Santo and Bahia have been the stage of many land conflicts between Suzano and local communities, including Indigenous and Quilombola (afro-descendent) communities, and landless farmers movements. In the state of Maranhão, many land conflicts arose with traditional communities when Suzano announced plans to build a pellet mill there, and communities lost lands to eucalyptus plantations. Years later, Suzano abandoned its plans, but the communities have not recovered their land.

Suzano’s continuous expansion of plantations is detrimental to the protection of rainforests and other ecosystems, and JPMorgan Chase should recognize that by continuing to finance agribusiness companies like Suzano, it is furthering their assault on the climate, forests, and human rights.

Saving forests is critical to stabilizing the climate, protecting global biodiversity, and supporting the livelihoods of over a billion people. Chase publicly acknowledged this when it joined a global banking initiative called the Soft Commodities Compact back in 2014. As a Compact signer, they

pledged to confirm that “their corporate and investment banking customers whose operations include significant production or processing of palm oil, timber products or soy in markets at high risk of tropical deforestation can verify that these operations are consistent with zero net deforestation by 2020.” Unfortunately, they’re still fueling deforestation.

That’s why we’re calling on Chase to reform its financing policies and make an explicit commitment to stop financing fossil fuels AND protect forests and peatlands and respect rights by adopting a No Deforestation, No Peatland, and No Exploitation (NDPE) policy. Join us here and hold Chase accountable for the impacts it’s having on the climate, biodiversity and local communities.