A private equity takeover of Kohl's Corp. could hurt the Wisconsin-based department store chain and its 110,000 employees. (AP Photo/Josh Reynolds)

The Wisconsin-based department store chain employs 110,000 nationwide and 4,000 at its corporate headquarters.

A possible takeover of Kohl’s Corp. by private equity firms could spell bad news for the Wisconsin-based department store chain and its more than 100,000 employees.

Kohl’s officials said two private equity firms, Sycamore Partners and Acacia Research, have expressed interest in buying the company, according to CNBC, the Wall Street Journal, and other media outlets. As a result, the company’s stocks rose 36% following the release of that news.

But retail analysts say the long-term impact may not be positive for the company and its employees beyond the immediate stock price bump, those news outlets reported. The company employs about 4,000 people at its corporate headquarters in Menomonee Falls and 110,000 overall.

Acacia Research proposed that Kohl’s sell many of its stores and lease them back from their new owners, an action that also was recommended by activist investors Macellum Advisors and Engine Capital to improve Kohl’s stock price.

RELATED: Nurses Up North Push for Better Pay Amid Pandemic Demands

While selling Kohl’s stores would generate cash for the company, it would mean future new costs for the company in the form of lease payments for those spaces, Anne Brouwer, a senior partner with retail consulting firm McMillan Doolittle, told Wisconsin Public Radio.

Another proposal calls for Kohl’s to make its e-commerce business separate from the company’s retail stores. However, retail analysts said Kohl’s could lose control of its brand by doing so.

During the past 20 years, private equity takeovers have increased dramatically, and those actions have risen even more during the coronavirus pandemic. A recent report measuring how government money has been spent during the pandemic notes that equity firms received more than $5 billion in Coronavirus Aid, Relief, and Economic Security (CARES) Act money despite those firms already having record amounts of cash.

During that same time period, department stores have struggled amid lost in-store sales as online retailers such as Amazon have become increasingly popular. In fact, analysts said, Kohl’s is among the only national department store chains remaining in the country.

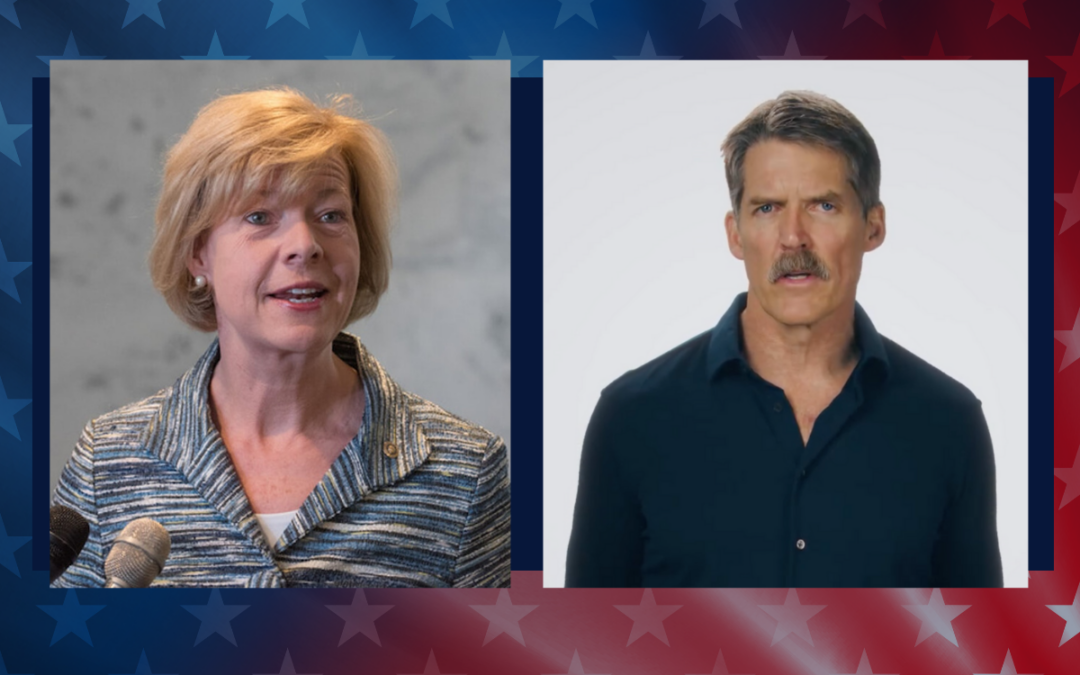

In October US Sen. Tammy Baldwin and US Rep. Mark Pocan, both of Wisconsin, joined other Democratic lawmakers in introducing legislation intended to protect employees when private equity takeovers happen. Baldwin and Pocan cited job losses in Janesville, Waukesha, and Green Bay because of takeovers in Wisconsin.

The legislation, titled the Stop Wall Street Looting Act, is intended to reform the private equity industry, in part by forcing private investment firms to be responsible for the businesses they acquire.

“We need to rip up the predatory playbook that these private equity firms are using to leave workers with nothing but pink slips,” Baldwin said in a press release.

Politics

What’s the difference between Eric Hovde and Sen. Tammy Baldwin on the issues?

The Democratic incumbent will point to specific accomplishments while the Republican challenger will outline general concerns he would address....

Who Is Tammy Baldwin?

Getting to know the contenders for this November’s US Senate election. [Editor’s Note: Part of a series that profiles the candidates and issues in...

Local News

Stop and smell these native Wisconsin flowers this Earth Day

Spring has sprung — and here in Wisconsin, the signs are everywhere! From warmer weather and longer days to birds returning to your backyard trees....

Your guide to the 2024 Blue Ox Music Festival in Eau Claire

Eau Claire and art go hand in hand. The city is home to a multitude of sculptures, murals, and music events — including several annual showcases,...