Pent-up consumer demand for dining out as lockdown eases

Tuesday, 30 March 2021

As England moves into its latest phase of lockdown easing, the hospitality industry is looking forward to the next stage on 12th April, when those with outdoor space will be able to serve customers.

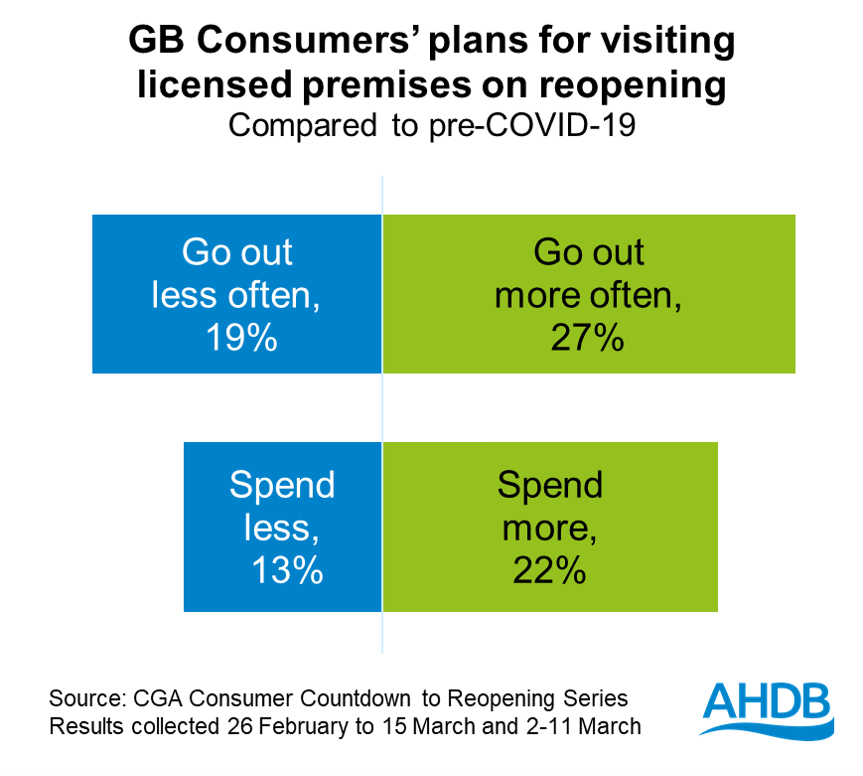

There is evidence of pent-up demand from consumers, with CGA’s latest survey showing that 27% of GB consumers plan to go out more often than they typically would pre-COVID. This outweighs the 19% of people who plan to go out less.

The CGA Consumer Countdown to Reopening series also shows that those who plan to dine out more than previous are more likely to be younger consumers. They are also more likely to be the in the 63% who have been saving money (including money they’d usually spend eating and drinking out).

Despite this excitement from many consumers, it doesn’t mean they are planning to splash out on premium venues. Almost half of consumers say they are most likely to visit inexpensive/mainstream venues. However, in the next stage of lockdown easing, it ultimately comes down to whether the venue has outdoor dining space.

Pubs more likely to benefit from outdoor dining

According to CGA, only 38.2% of licensed premises have an outdoor space in which they could potentially seat guests outdoors. While people are keen to visit a restaurant, pubs are more likely to have such outdoor space (80.5% compared to just 11.9% of casual dining restaurants), so this next stage of easing will be in their favour. Not all premises will open their doors – profitability will be a huge challenge as reduced capacity is unlikely to offset costs. The weather will also be a huge influence on the fortunes of pub gardens and outdoor dining spaces from 12th April onwards.

Two in five more price conscious

While many are excited about dining out, some 22% of consumers have seen disposable income decrease and 14% are facing financial hardship. This correlates to the fact 42% of respondents in the AHDB/YouGov Consumer Tracker say they have become more price conscious than they were prior to the pandemic (Feb 2021). The Tracker also shows that, of those planning on eating out less that prior to the pandemic, 45% say it’s because they need to save money.

The eating-out market is an important channel for food sales. For instance, in 2019, AHDB estimates show that 11% of beef volumes go through eating-out, 6% of lamb, 13% of pork and 7% of potatoes. We know over half of foodservice visits include dairy. While there is general positivity from consumers, there is still some that remain cautious. Combined with the financial impact of extended closures on foodservice operators, this supports the view we took in the Agri-Market Outlook that recovery would be slow.

Related content

Topics:

Sectors:

Tags: