Marco Rubio's Extreme Tax Plan

Though the senator may be running as a moderate, his proposal is anything but.

Senator Marco Rubio is running as the acceptable moderate among the three leading Republicans presidential candidates, compared to Senator Ted Cruz and Donald Trump. But as the nonpartisan Tax Policy Center reported yesterday, his tax plan is not moderate, and it is scarcely acceptable.

Rubio’s proposals would deliver a $1 million tax break to the richest 0.1 percent of the country in its first year and slash government revenue by $6.8 trillion over the next decade. To avoid adding to the deficit, it would require “unprecedented” spending cuts, according to TPC. But that’s not all. Rubio has also called for higher military spending, delayed cuts to Medicare and Social Security, and a Balanced Budget Amendment. To appreciate the impossibility of balancing the budget while raising military spending and slashing taxes at unprecedented levels, try running a marathon while fasting.

Rubio’s budget is an unwieldy buffet, with morsels to lure every man, woman, and child, provided they don’t think too hard about the math. There is the abolition of investment tax cuts for the rich, and tax credits for the poorer; Medicare for moderates, and balanced budgets for conservatives; Social Security for the old, but the promise of long-term entitlement reform for the young. The result is a plan that promises everything to everyone and leaves nothing to arithmetic. If Rubio’s budget plan went through as written, it would require effectively dismantling every other government program not mentioned in this paragraph. And since government spending is disproportionately skewed toward helping the poor, sick, and old, this would mean cutting unfathomably deep into decades-long commitments to America’s most vulnerable citizens.

It would be one thing if Rubio’s plan represented an extreme version of Republican tax policy. But at this point, multi-trillion-dollar tax cuts, combined with huge savings for the wealthy, and unprecedented spending cuts that fall heavily on the poor now appear to be a mandatory component of every Republican budget plan.

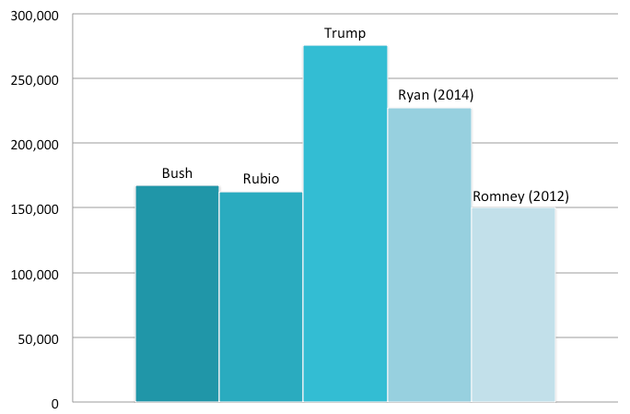

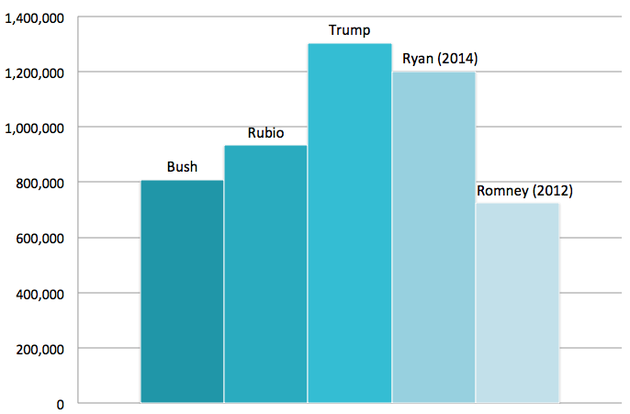

Rubio’s plan would cut taxes by $162,000 for the top 1 percent and $932,000 for the top 0.1 percent, while reducing overall revenue by almost $7 trillion. Compare that to plans of his fellow candidates and GOP luminaries:

- Jeb Bush’s plan: $167,000 cut for the top 1 percent; $808,000 cut for the top 0.1 percent; $6.8 trillion cut to overall revenue over ten years

- Donald Trump’s plan: $275,000 cut for the top 1 percent, $1.3 million cut for the top 0.1 percent, $9.5 trillion cut to overall revenue

- Mitt Romney’s 2012 plan: $150,000 cut for the top 1 percent, $725,000 cut for the top 0.1 percent, $5 trillion cut to overall revenue over ten years

- Paul Ryan’s 2014 plan: $227,000 cut for the top 1 percent, $1.2 million cut for the top 0.1 percent, $5.7 trillion cut to overall revenue

It’s time to dispel the fiction that mainstream Republicans don’t know what they’re doing when it comes to tax policy. They know exactly what they’re doing. Each plan cuts top-percentile income by at least $150,000. Each plan cuts 0.1 percentile by at least $725,000. Each plan reduces overall revenue by at least $5 trillion. The playbook couldn’t be clearer.

How Much Each GOP Plan Would Cut Taxes for the Top

1 Percent of Earners

1 Percent of Earners

How Much Each GOP Plan Would Cut Taxes for the Top

0.1 Percent of Earners

0.1 Percent of Earners

To be fair, Bernie Sanders’ would raise taxes by an amount that is similarly unprecedented. Although TPC has not provided its own detailed estimate of the cost, his proposal clearly exists on a separate plane from political feasibility. But Sanders is an avowed socialist who’s so far outside the norm of the Democratic Party that he’s not even a member. On the other side of the aisle, it’s the establishment GOP that has self-deported from reality.

Conservatives counter that tax cuts might invigorate investment, spur entrepreneurship and hiring, and accelerate growth. This may be, but defenders of President George W. Bush said the same about his 2001 and 2003 tax cuts, and few recall the last 15 years for their magical growth rates. The truth is that nobody knows how an unprecedented budget upheaval would affect the rate of GDP growth in a complex global economy, because, well, it is hard to forecast something that is unprecedented. But we know something else: If you drastically cut taxes for millionaires and promise to make it up in cuts to safety-net programs, you will get richer millionaires and weaker safety nets. Now, which Republican candidate is brave enough to put that message on repeat?

Related Videos

Derek Thompson is a staff writer at The Atlantic and the author of the Work in Progress newsletter.